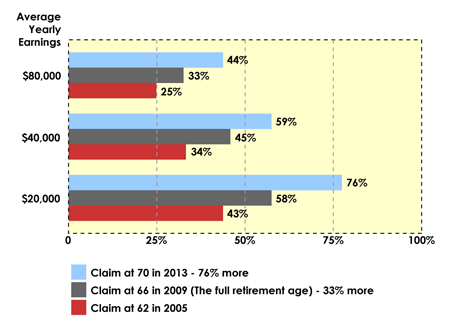

The later you claim, the more you get.

The monthly benefit you earn as a worker is generally based on when you start to collect and the average of the highest 35 years of earnings on which you’ve paid Social Security payroll tax.

75% of original income is need to keep your standard of living.

*As the Full Retirement Age rises to 67, benefits claimed at any age will replace a smaller share of earnings.

——————————————————————————————————————–

You get even more…

…if working longer raises the average of the highest 35 years of earnings on which you’ve paid Social Security payroll tax. For example, say you were 62 in 2005 and had 31 years of employment, at $40,000 a year.

If you retire and start to collect benefits at 62:

The average of your highest 35 years of earnings = $35,400

your monthly benefit, based on your average earnings and claiming age = $1,030

——————————————————————————————————————–

If you work four more years, at $40,000 a year, and retire at 66:

The average of your highest 35 years of earnings = $40,000

your monthly benefit, based on your average earnings and claiming age = $1,500

33% for claiming later + 12% more for more earnings = 45% more overall

© 2009, by Trustees of Boston College, Center for Retirement Research

Does not represent the Social Security Administration.