Social Security is especially good for providing a basic retirement income that you and your spouse can rely on. The income it provides is inflation – proof and keeps coming as long as you or your spouse is alive.

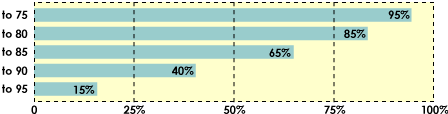

Your chances for a very long life are excellent

Chances that one person in a married couple, both age 62, will live…

Inflation-Proof!

You get more dollars from Social Security if prices rise, so what you can buys stays the same.

Employer pensions and private annuities provide a guaranteed income for the rest of your life.

But they are rarely inflation-proof. If prices rise 3% a year, in 20 years they’ll buy barely half what they do today.

401(k)s, Individual Retirement Accounts (IRA)s, and other savings can be invested in stocks that could produce high returns, saved for rainy days, or passed on to your children.

But high returns bring increased risk, and financial shocks are likely over the course of your retirement. On the other hand, cash in the bank is not inflation-proof.

Work is an important source of income for some retirees.

But few people work past 70. So relying too much on earnings could be a big mistake.

*Social Security will likely be much more important as you age, as other sources of income often dry up.

© 2009, by Trustees of Boston College, Center for Retirement Research